6 minute read

Approaches such as value, aspirational and lifestyle marketing are generally most strongly associated with consumer goods. Brands such as Apple and Nike, as well as many others, have molded the blueprint for drawing in consumers to buy into a version of themselves that they aspire to. However it would be wrong to relegate this approach purely to the realms of consumer goods. As public attitudes towards sustainability are changing, we are increasingly seeing other industries being impacted by consumers desire to act in line with their moral and ethical sensibilities, reflecting both how they behave now but also how they would like to behave in the future – in other words the ideal version of themselves. A good example of this is the success of the likes of Bulb and Octopus Energy (suppliers of green energy to the UK retail market) as well as the increasingly popularity of vegetarian and vegan restaurants and products as people increasingly try to make the way that they live their lives more sustainable.

Strategies that were once deemed to belong to the world of luxury consumer goods can be applied to the marketing of financial services products. Whilst this certainly has a retail flavour on first examination, it is worth noting that consumer interest in financial services products is on the rise in a way that is likely to have wider repercussions.

Engagement with pensions and savings

Whilst the (lack of) engagement of much of the general public with the investments that make up their pensions has long been an area of frustration for many in the financial services industry. However increased concern for the future of our planet is driving many consumers to be more engaged with how their pensions are invested. As with most other trends in sustainability and responsible investing, the Nordic economies are in the vanguard of this trend. In the UK, awareness efforts from climate change charities and activists are becoming more prevalent and effective. As the end beneficiaries of pension schemes put more pressure on the scheme administrator, this will flow through to the asset managers who look after them.

Examples:

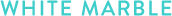

Make My Money Matter – calling on individuals, organisations, governments and industry to align their pensions with their values to build a more sustainable future.

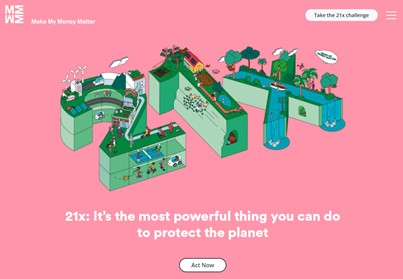

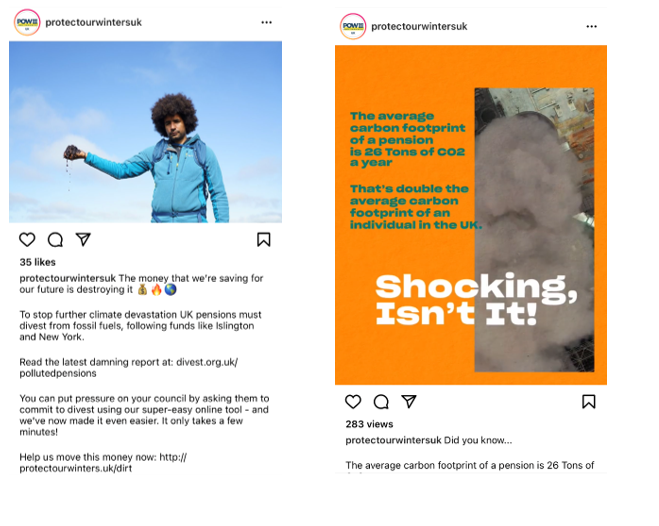

Protect Our Winters – climate change charity emerging from the winter sports industry. Their campaign #divestthedirt asks their supporters to call on their local councils to move their pensions away from investing in fossil fuels.

Aspirational/value marketing

In an article first published in 2012 entitled ‘What’s with all the hype – a look at aspirational marketing’, Murray Hunter1 writes: “Our realities are about what we dream and would like it to be rather than what it is. Aspirational brand strategy is concerned with creating the dream and generating positive emotional reactions from emotional reactions from consumers (Hill 2010). An aspirational brand strategy tries to fit a product into consumers’ attitudes and emotions so they will identify with the product. Aspirational brand strategy is based on the premise that emotions play an important role in our purchase decision making and that rationality in purchase decision making is fallacy (Mckee 2007).”

Hunter goes on to write that “aspirational brand strategy is about being innovative and providing people with the means of fulfilling their aspirations … The starting point for aspirational brand strategy is imagination. Imagination is an aid to practical thinking and opens the door to making purchasing decisions (Brown & Patterson 2000). All our hopes, enlightenment, fears, and desires come from imagination. Brands are able to give consumers a sense of identity and enrich their life experiences.”

An aspirational brand strategy may appeal to clients’ aspirations, who they want to be, rather than their current state. Asset and wealth management is uniquely positioned to act as a facilitator to help clients to act on their desires to behave in a different, perhaps ‘better’ way by enabling them to invest responsibly, ethically, or with impact depending on their specific requirements.

Authenticity is, as ever, key when using aspirational marketing as a tactic. Brands that claim, or appear to claim, to personify certain value, or aspirations, are vulnerable to reputation damage should they be exposed as not truly living up to this promise. In other words, greenwashing.

Optional Read: Full article: Murray Hunter – What’s with all the hype – a look at aspirational marketing

Optional Read: Full article: Murray Hunter – What’s with all the hype – a look at aspirational marketing

Aspirational marketing in the context of climate change anxiety

In Module 1 we discussed some of the effects climate change can have on people’s health, including eco-anxiety, which is gaining increasing recognition and attention from medical professionals and mainstream media alike.

While a number of causes contribute to this, the marketing of sustainability has likely played a fair role.

In their report ‘Sizzle. The new climate message’, the sustainability communications agency Futerra points out that to date most sales and marketing campaigns around climate change, and sustainability in general, have been focused on highlighting the negative potential impacts of climate change. However, this approach hasn’t significantly influenced people’s attitude or behaviour. To quote Futerra: “threats of climate hell haven’t seemed to hold us back from running headlong towards it”.

Instead, Futerra suggests a shift in how sustainability messaging, especially around climate change, can be constructed. We need to “build a visual and compelling vision of low carbon heaven”. This is an approach that is being adopted by many corporations globally. Asset managers are no exception, with sustainability slogans and taglines alluding that investing together will ensure a more sustainable future.

However, the vast majority of these statements, positions, and messages only go as far as explaining what could be achieved (a “more sustainable future”); they do not go further to “build a visual and compelling vision”. This is something the Financial Reporting Council is also seeking to address in the updated UK Stewardship Code requirements. From a reporting perspective, successful signatories must demonstrate not just a general statement of intent, but the impact of engagements and activities (See Module 2 for a more detailed discussion of the UK Stewardship Code 2020).

Organisations need to paint a more tangible and compelling picture of the sustainable future that they are working towards.

Read: Futerra – Sell the sizzle pg 5-6

Read: Futerra – Sell the sizzle pg 5-6

Key points:

- A four-step narrative on sustainability, particularly around climate issues, has the most favourable receptions: Vision -> choice -> plan -> action

- An open communication around what ‘heaven’ looks like captures and holds people’s attention

- Make it visual

- Make it national or local – i.e. more relatable and relevant

- Make it desirable

- Cut the dates and figures “A 20% cut by 2020 isn’t a vision, it’s a target. Put all the targets together and imagine what the world would be like if we met and exceeded them: that’s a vision.”

- Show the choice between the ‘heaven’ and the ‘hell’ of unmitigated climate change – make it clear that this is the time to decide to actively choose the better version of the future

- Offer a simple and achievable plan of action – it needs to be both significant and achievable, and over a relatable timeframe – five years is optimal

- Finally, lay out specific personal actions that everyone can take

1Murray is the Asia and Oceania Analyst for the Eurasia Review, Vice Chairman of the advisory board of Modern Diplomacy, former correspondent for the Asian Correspondent, a long-time contributor to the Asia Sentinel and Geopolitical Monitor, and an associate professor at the University Malaysia Perlis.