7 minute read

The business case for sustainability/ ESG

Read: Harvard Business Review – The Comprehensive Business Case for Sustainability by Tensie Whelan & Carly Fink

Read: Harvard Business Review – The Comprehensive Business Case for Sustainability by Tensie Whelan & Carly Fink

Key points:

- Academic research and business experience are overturning previously held conceptions that the costs of integrating sustainability into a company’s business model outweighed the benefits.

- Businesses can benefit from the strategic integration of sustainability in several ways:

- Deriving a competitive advantage through engagement with broader stakeholder groups, better enabling a company to anticipate and react to economic, social, environmental and regulatory changes.

- Due consideration of sustainability factors can contribute to risk mitigation, particularly in global supply chains that are especially vulnerable to climate change, resource scarcity and labour efficiency.

- Effective risk mitigation can reduce the chance of having stranded assets – investments that become obsolete due to regulatory, environmental, or market constraints.

- Consumers are increasingly sustainability-minded and tend to favour products that are good for the environment and society – this has direct implications on sales revenues and customer loyalty.

- Companies with strong sustainability initiatives and corporate social responsibility (CSR) have lower employee turnover and engender greater employee loyalty.

- There is increasing evidence of a correlation between performance and the integration of sustainability factors.

- Investors increasingly place pressure on companies to issue non-financial disclosures related to their business decision-making.

Investing with sustainability / ESG factors does not require a performance sacrifice

One of the dominant arguments from ESG sceptics and traditional investors in recent years has been that investing for sustainability is not compatible with generating maximum returns. However, the evidence increasingly suggests that this is simply not the case.

Over a 10-year period, there is no penalty at a sector or geographic level for investing in companies with exposure to green revenues. The average spread between ‘green’ and ‘brown’ portfolios over the time period is -3 basis points, which is statistically equivalent to zero.

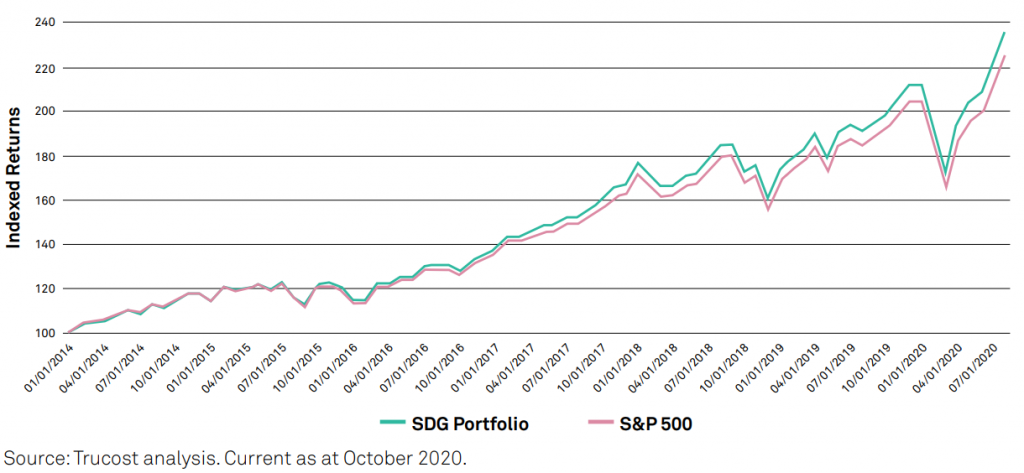

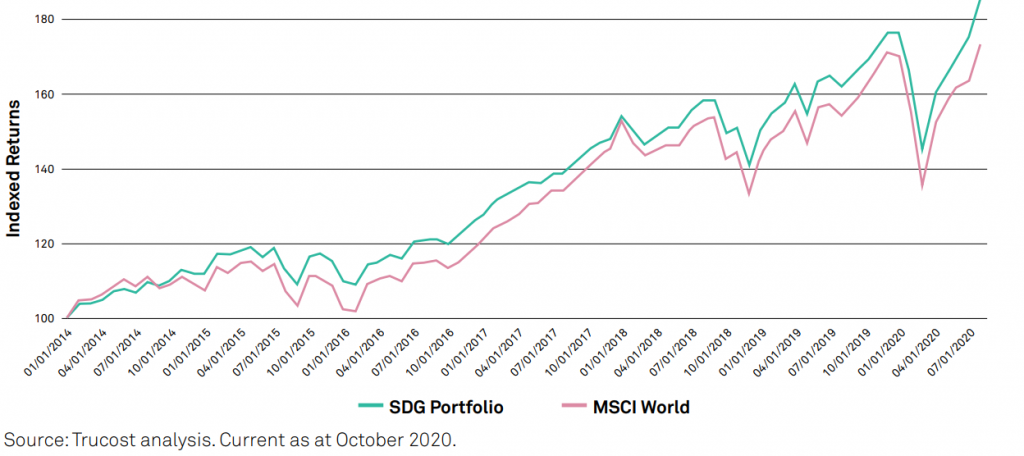

Since the sustainable development goals (SDGs) were implemented seven years ago, the performance of portfolios aligned to the SDGs have outperformed major indices. The greater the alignment, the greater the out-performance.

SDG portfolios outperformed the S&P 500 by +10.4% to October 2020

SDG portfolios outperformed the MSCI World Index by +12.7% to October 2020

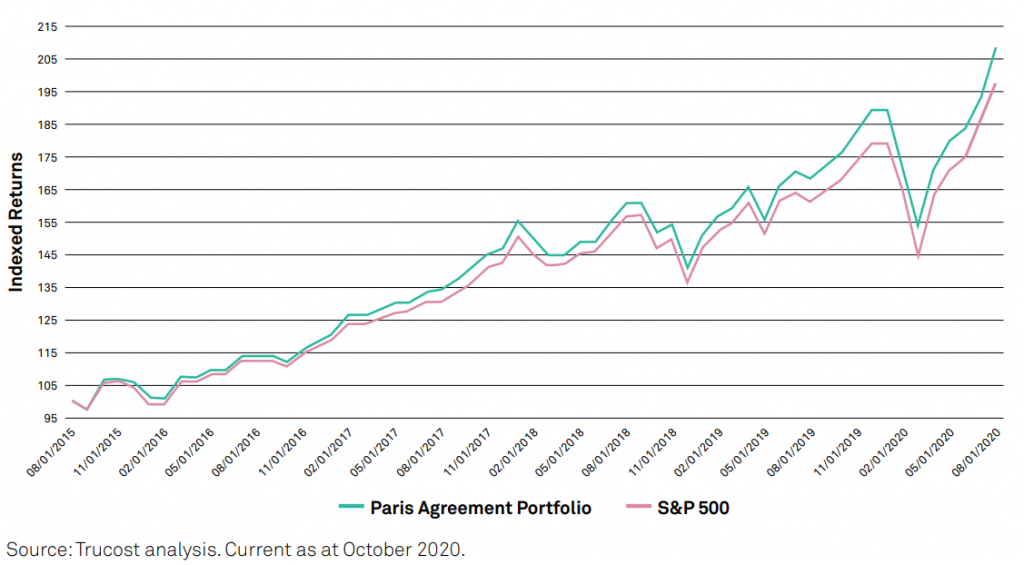

Since the Paris Agreement in 2015, portfolios aligned to the Agreement principles have outperformed the S&P 500 by +11% to October 2020

Recommended Reading: The full report from which the above data was sourced, ESG Data Signals – Trucost Sustainable Development Goals (SDG) Analytics

Recommended Reading: The full report from which the above data was sourced, ESG Data Signals – Trucost Sustainable Development Goals (SDG) Analytics

Discussion exercise

Discussion exercise

One of the most common arguments to resist Responsible/ Ethical/ Impact/ ESG investing in recent years has been that it requires a sacrifice on returns. Have you come across this attitude in your day-to-day job as a marketer? What, if any, approaches have you taken to overcome this challenge?

Share your thoughts in the discussion forum here.

Key players and their roles

Various stakeholders shape the demand for and supply of responsible investment through the choices that they make and/or the services and information that they provide.

The main stakeholders are:

Asset owners who set the tone for the investment value chain. Their understanding of and appetite for ESG factors in investment processes drive the breadth and quality of ESG and responsible investing products and offerings.

- Pension funds – given their long-term nature, ESG factors are particularly relevant to pension schemes in their efforts to meet their long-term liabilities. As fiduciaries of the pension fund members, pension fund trustees have a responsibility to act in the best interest of their members. Recent litigation in Australia and the UK has indicated that pension fund trustees may be open to legal action if they fail to consider the long-term effects of, particularly, climate change, as well as other ESG factors.

- Insurance – insurance companies are, by nature, especially sensitive to certain ESG factors. These include the impact, frequency and strength of extreme weather events on property and casualty insurance, and the effects of demographic change on life insurance. For these reasons, insurance firms have developed an advanced understanding around responsible investment.

- Individual (retail) investors and wealth managers – generally, in Europe, retail investors have been slower than institutional players to integrate ESG factors into their investment decisions. However, we have seen record flows in recent years. The reasons are manifold – most often cited are the more socially and environmentally – oriented views of millennials, who represent an increasing proportion of high net-net-worth (HNW) and ultra-high-net-worth (UHNW) investors. In addition, the last few years have also seen greater general awareness of the impacts of both environmental change and social inequality.

Asset managers influence the ESG characteristics of the portfolio they are responsible for through stock selection, as well as engagement with their investee companies on a range of issues. Asset managers are both reactive to asset owners’ interest and play a role in proposing new products and approaches to their clients.

Fund promoters can consider ESG characteristics of funds in their screening and short-listing of funds to clients.

- Investment consultants and retail investment advisors are often considered the gatekeepers for the expansion of ESG investing as they are a trusted source of advice for asset owners and individual investors. However, to date, research from the Principles for Responsible Investment (PRI) suggests that they are not considering ESG issues in their investment practice to a significant extent.1

- Investment platforms’ research and recommendations can be highly influential as either a positive or a negative driver of interest in and demand for ESG products.

- Fund labelers provide benchmarks and quality guarantees for both practitioners and clients. Labels are usually either general or thematic.

Financial services firms (defined by the CFA Institute as: investment banks, investment research and advisory firms, stock exchanges, financial and ESG ratings agencies) are important enablers of responsible investment as they influence the availability of higher quality ESG securities and the quality of information available.

Improvements in data sourcing and analysis have also contributed to the growth of the ESG market.

Policy makers and regulators have the goal to:

- Maintain orderly financial markets;

- Safeguard investments in financial instruments, savings/ pensions and investment vehicles; and

- Bring about an orderly expansion of activities of the financial sector.

They also consider how ESG factors might impact the stability of economies and financial markets, as well as the influence on the long-term risk-return profile of financial-instruments. They can also encourage the growth of ESG products and require disclosure on ESG characteristics.

In addition, some regulators can directly influence companies by strengthening disclosures and requirements in areas such as: environment, labour, communities and governance.

Regulations generally cover three themes:

- Corporate disclosure: guidance typically comes from governments or stock exchanges, encouraging or requiring companies to report on material ESG risks. Thus, improving the ability of investors to consider these factors.

- Stewardship: regulation regarding the interactions between investors and investee companies whilst seeking to protect shareholders and beneficiaries as well as the health and stability of the market.

- Asset owners: generally focused on pension funds, regulation can require them to integrate ESG factors and disclose their processes and outcomes.

More detail on regulation and policy by region, and the challenges that this poses, will be covered in Module 2.

Investees – decision makers at investee companies, projects, agencies or jurisdictions can influence how they manage ESG risks and their impact on the environment and society. They also have a high degree of agency regarding levels of disclosure of ESG-related data, contributing to one of the biggest issues facing ESG investing – the lack of access to and consistency of, ESG data.

Governments – there are three main ways in which responsible investing can contribute to positive outcomes for society:

- Providing a private alternative to increasingly pressurised social security and public pension systems;

- The construction and/ or restoration of public infrastructure; and

- The inevitable shifts of capital required in the transition to a low-carbon economy.

These are all areas where governments can encourage the consideration of the social and environmental impacts of investments to advance national priorities.

Civil societies and academia – non-governmental organisations (NGOs) have played a significant role in promoting increased sustainability and transparency from companies. Academic research has also been influential in validating the business case for integrating ESG factors into investment decisions.

There are an increasing number of initiatives and support networks appearing to help support and encourage companies, governments, and individuals to reach the goals needed to meet the Paris Agreements goal to limit global warming to 1.5 degrees Celsius above pre-industrial levels.

- The Net Zero Asset Managers Initiative aims to ‘galvanise the asset management industry to commit to a goal of net zero emissions’.

- The Net-Zero Asset Owners Alliance seeks to transform member investment portfolios to net zero greenhouse gas (GHG) emissions by 2050.

- Race to Zero is a global campaign to rally leadership and support from businesses, cities, regions, investors for a healthy, resilient, zero carbon recovery.

1PRI. 2021. Investment consultants services review. [online] Available at: <https://www.unpri.org/sustainable-financial-system/investment-consultants-services-review/571.article> [Accessed 17 September 2021].