9 minute read

Reporting frameworks

In addition to the growing regulatory requirements discussed in Module 2 there are a number of voluntary frameworks that have been developed by NGOs, nonprofit organisations and research institutes to contribute to advancing best practice.

The Value Reporting Framework

The Value Reporting Foundation is a non-profit organisation formed in June 2021 by the merging of the Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) in an effort to achieve greater clarity and simplicity in the corporate reporting landscape.

As the concepts of sustainability and intangible value are growing in significance and consideration, the corporate reporting landscape needs to evolve to meet these needs. The Value Reporting Foundation provides a range of resources to help business and investors develop a shared understanding of enterprise value – how it is created, preserved and eroded.

This includes three frameworks (from the former IIRC and SASB) that business can use alone or in conjunction with each other depending on their needs:

The Integrated Thinking Principles – designed to guide board and management planning and decision making.

The Value Reporting Foundation defines Integrated Thinking as a management approach for thinking holistically about the resources and relationships the organisation uses or affects, and the dependencies and trade-offs between them as value is created.

Through integrated thinking, organisations are better placed to tailor the business model and strategy to respond to the external environment it operates in and understand the risks and opportunities it faces.

The more integrated thinking is embedded into an organisation’s activities, the more naturally the connectivity of information will flow into reporting, analysis and decision-making.

When management has access to robust data, as provided by the SASB Standards, they are better placed to make informed decisions. The Integrated Reporting Framework enables organisations to communicate this clearly externally.1

The Integrated Reporting Framework – designed to provide principles-based, multi-capital guidance for comprehensive corporate reporting.

The Value Reporting Foundation defines Integrated Reporting as bringing together material information about an organisation’s strategy, governance, performance and prospects in a way that reflects the commercial social and environmental context within which it operates. It provides a clear and concise representation of how the organisation creates value now and in the future.2

SASB Standards – a tool to inform investor decision making when embedded in investment tools and processes. SASB provides detailed, industry-specific disclosure topics and metrics to inform what to include in an integrated report, depending on that subset of sustainability issues that are most relevant to a given organisation’s ability to create long-term value for investors.

The Standards address sustainability-related risks and opportunities reasonably likely to affect an organisation’s financial condition (i.e., its balance sheet), operating performance (i.e., its income statement), or risk profile (i.e., its market valuation and cost of capital).

IFRS

The IFRS Foundation is a not-for-profit, public interest organisation established to develop a single set of high-quality, understandable, enforceable and globally accepted accounting standards—IFRS Standards—and to promote and facilitate adoption of the standards.

IFRS Standards are set by the IFRS Foundation’s standard-setting body, the International Accounting Standards Board.

![]() Watch: IFRS – Who we are

Watch: IFRS – Who we are

Key points:

- Financial information in the lifeblood of capital markets

- As increasing capital transactions are cross border – there is a growing need for trustworthy, standardised financial information

- Over 100 countries require companies to use IFRS standards when reporting on financial performance

- IFRS standards aim to bring three key benefits to the world economy:

- Transparency – high quality and comparable information

- Accountability – reduce the information gap between those on the inside of a company and those on the outside – helps hold company management to account

- Efficiency – a single standard lowers the cost of capital and reduces the costs of reporting

- The goal is to foster trust, growth, and long-term financial stability in global financial markets

Principles for Responsible Investing (PRI)

Signatories of the PRI are required to report annually on their responsible investment activities.

The updated PRI reporting framework groups mandatory and voluntary disclosures into two buckets – core and plus:

| Core | Plus |

Relatively stable, closed-ended, process focused questions that are mandatory to report on and disclose and will be assessed | Evolving, process- and outcome– focused open-ended questions that are voluntary to report on and will not be assessed |

The reporting framework has two types of questions, focused on processes and outcomes:

| Processes | Outcomes |

– How ESG factors are incorporated – How outcomes are assessed and understood | – What these outcomes are |

– How ESG factors are incorporated into an organisations’ overall approach to responsible investment and their asset allocation decisions – How signatories assess and understand sustainability outcomes, and how signatories may be measuring these outcomes | – What the sustainability outcomes of investments are |

![]() Recommended Reading: The PRI Reporting Framework – overview and structure pages 7 – 11 provides an overview of the core components and where they are situated in the overall reporting framework.

Recommended Reading: The PRI Reporting Framework – overview and structure pages 7 – 11 provides an overview of the core components and where they are situated in the overall reporting framework.

Reporting on Diversity, Equality & Inclusion (DE&I)

UK Corporate Governance Code

The most recent iteration of the UK Corporate Governance Code issued in 2018 recommends that companies set out clear disclosures on diversity including gender, any measurable objectives that have been set, and progress on these objectives.

Pay gap disclosures

Since 2017 companies in the UK who employ over 250 are mandated to report on the difference in average pay between men and women.

Employers need to publish six calculations showing:

- Mean gender pay gap in hourly pay;

- Median gender pay gap in hourly pay;

- Mean bonus gender pay gap;

- Median bonus gender pay gap;

- Proportion of males and females receiving a bonus payment;

- Proportion of males and females in each pay quartile. 3

Whilst this is not a requirement in the USA at this stage, increasing interest in and focus on the topic is leading to increasing shareholder pressure on corporate management to be more transparent on gender-pay disclosure.4

![]() Read: Human Rights Reporting Requirements in the UK

Read: Human Rights Reporting Requirements in the UK

Key points:

- The UN Guiding Principles on Business and Human Rights set the expectation that companies should identify and address human rights risks, and track and communicate how effectively they do so.

- The Companies Act 2016 and EU Non-Financial Reporting Directive 2014 requires that UK listed companies with over 500 employees report on non-financial information, including information relating to human rights – including the company’s policy and its outcomes, due diligence processes, principal risks, and (where relevant) its business relationships, products or services that are likely to cause adverse impacts, along with information about how those risks are managed.

- The Modern Slavery Act 2015 requires business with a turnover of £36 million or more to publish an annual slavery and human trafficking statement on their website.

- The Financial Reporting Council’s non-mandatory Guidance on the Strategic Report states that a strategic report should contain ‘material’ information. It explains that ‘information is material if its omission or misrepresentation could influence the economic decisions shareholders take on the basis of the annual report as whole’.

Other reporting/ frameworks

Greenhouse Gas Protocol Corporate Accounting and Reporting Standard – provides guidance for organisations to report GHG emission at a corporate level. It covers the accounts and reporting of the seven greenhouse gasses covered by the Kyoto Protocol (carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PCFs), sulphur hexafluoride (SF6) and nitrogen trifluoride (NF3). It was updated in 2015 with the Scope 2 Guidance, which allows companies to credibly measure and report emissions from purchased or acquired electricity, steam, heat, and cooling.

Partnership for Carbon Accounting Financials (PCAF) – an industry-led partnership to facilitate transparency and accountability of the financial industry to the Paris Agreement, working together to develop and implement a harmonized approach to asses and disclose the greenhouse gas emissions associated with loans and investments.

GRI Standards – designed to help organisations of all sizes to ‘understand and report on their impacts on the economy, environment and people in a comparable and, thereby increasing transparency on their contribution to sustainable development.’

The standards are split into three modules that enable organisations to customise a reporting framework that is applicable to their business activities:

The Universal Standards – apply to all organisations. The new revised standards come into effect from January 2023 and have been updated to be more forward looking and to incorporate reporting on human rights and environmental due diligence

The Sector Standards – the new sector standards will develop standards for 40 sectors to enable more consistent identification and reporting on sector–specific impacts. They will ‘describe the sustainability context for a sector, outline organisations’ likely material topics based on the sector’s most significant impacts, and list disclosures that are relevant for the sector to report on’.

The Topic Standards – identify disclosures relevant to a particular topic. Each Standard incorporates an overview of the topic and disclosures specific to the topic and how an organisation manages its associated impacts. Organisations select the topics that correspond to the issues they have identified as material.

![]() Recommended Read: A Short Introduction to the GRI Standards

Recommended Read: A Short Introduction to the GRI Standards

CDP – formerly the Cardon Disclosure Project. Runs a global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts.

The CDP has three areas of focus:

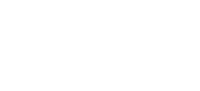

The Natural Capital Protocol – a decision-making framework that enables organisations to identify, measure and value their direct and indirect impacts and dependencies on natural capital.

The Protocol Framework explores 4 Stages broken down into 9 Steps which contain questions to be answered when integrating the value of natural capital into organizational processes.5

System of Environmental Economic Accounting (SEEA)– a framework that ‘integrates economic and environmental data to provide a more comprehensive and multipurpose view of the interrelationships between the economy and the environment and the stocks and changes in stocks of environmental assets, as they bring benefits to humanity’.

SEEA covers eight thematic areas:

- Agriculture, forestry and fisheries

- Air emissions

- Energy

- Environmental activity

- Ecosystems

- Land use

- Material flow

- Water

GRESB – provides a consistent framework to measure the ESG performance of individual assets and portfolios based on self-reported data. Performance assessments are guided by what investors and the wider industries consider to be material issues, and they are aligned with the Sustainable Development Goals, the Paris Climate Agreement and major international reporting frameworks.

Data reported to the GRESB Assessments are validated by a third party and scored before being used to generate the following ESG benchmarks for the industry:

- Real Estate Benchmark

- Real Estate Development Benchmark

- Infrastructure Fund Benchmark

- Infrastructure Asset Benchmark

UN Global Compact Ten Principles – the principles are derived from: the Universal Declaration of Human Rights, the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work, the Rio Declaration on Environment and Development, and the United Nations Convention Against Corruption.

- Businesses should support and respect the protection of internationally proclaimed human rights, and;

- make sure that they are not complicit in human rights abuses

- Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining;

- The elimination of all forms of forced and compulsory labour;

- The effective abolition of child labour; and

- the elimination of discrimination in respect of employment and occupation.

- Businesses should support a precautionary approach to environmental challenges;

- undertake initiatives to promote greater environmental responsibility; and

- encourage the development and diffusion of environmentally friendly technologies

- Businesses should work against corruption in all its forms, including extortion and bribery.6

1The Value Reporting Foundation. 2021. Resources Overview – The Value Reporting Foundation. [online] Available at: <https://www.valuereportingfoundation.org/resources/resources-overview/#integrated-thinking-principles>.

2The Value Reporting Foundation. 2021. Resources Overview – The Value Reporting Foundation. [online] Available at: <https://www.valuereportingfoundation.org/resources/resources-overview/#integrated-thinking-principles>.

3Equalityhumanrights.com. 2021. Gender pay gap reporting | Equality and Human Rights Commission. [online] Available at: <https://www.equalityhumanrights.com/en/advice-and-guidance/gender-pay-gap-reporting>.

4Rao, G., 2021. Companies say they want to close the gender-pay gap. So why are they trying to block relevant disclosures to investors?. [online] MarketWatch. Available at: <https://www.marketwatch.com/story/companies-say-they-want-to-close-the-gender-pay-gap-so-why-are-they-trying-to-block-relevant-disclosures-to-investors-11631716349>.

5Capitals Coalition. 2021. Natural Capital Protocol – Capitals Coalition. [online] Available at: <https://capitalscoalition.org/capitals-approach/natural-capital-protocol/?fwp_filter_tabs=training_material>.

6 2021. [online] Available at: <https://www.unglobalcompact.org/w>.