2 minute read

One of the key concepts for appropriate and useful reporting in the concept of sustainability and ESG factors is the concept of materiality.

In accounting, information is material if it’s omission or misstatement could influence the economic decisions of, for example, investors. (IASB Framework) Materiality is typically measured both in terms of the likelihood and magnitude of impact.

In the context of ESG investing, the CFA Institute defines a factor as being material ‘if it will drive long-term financial value in a particular business.’

Determining which ESG issues are most material is not an exact science, and there might be differences between what management and individual investors consider most material, even when analysing the same company. Not every ESG factor is material to every company all the time and investors need to consider the factors that are material to a business at a given time.

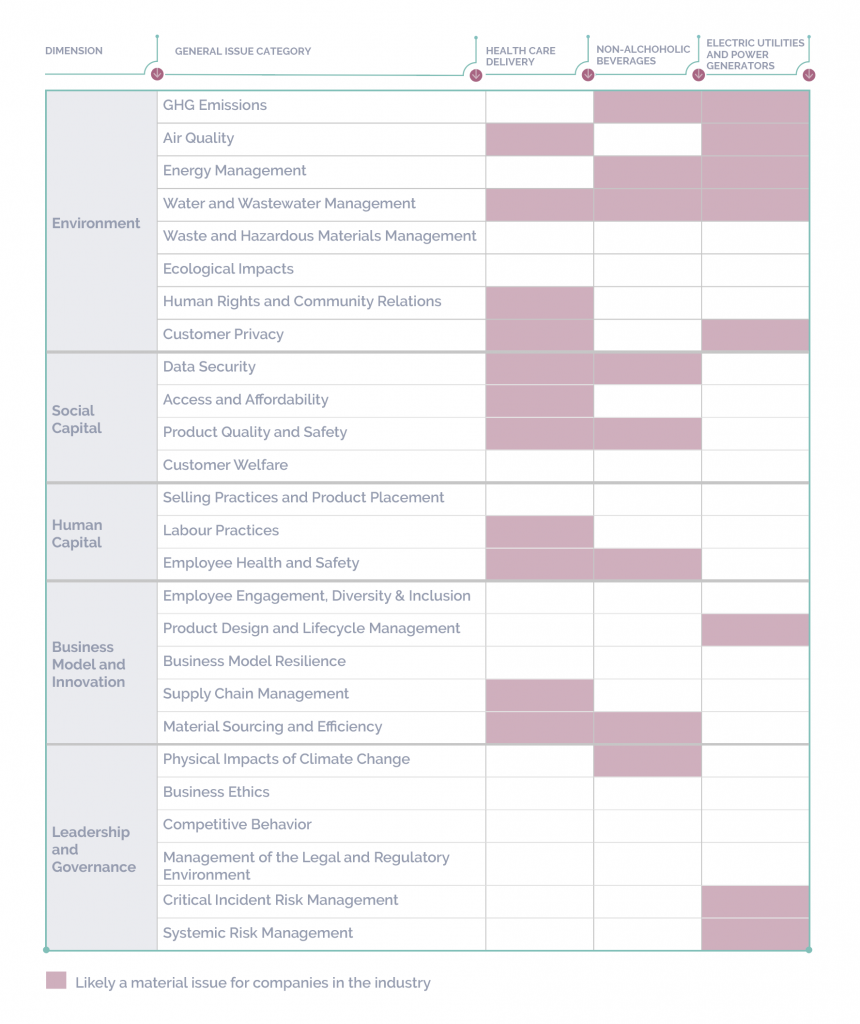

Frameworks such as the materiality maps provided by the Sustainability Accounting Standards Board (SASB) are helpful in providing some guidance, but investment professionals often develop their own view on what is most material.

The example below from SASB demonstrates how three sample sectors have different sustainability risks and opportunities. Clearly this is generalized at an industry level, individual companies within those sectors will vary.1

You can use the search feature on the SASB site to explore the key issues that are generally material to different industries, as well as specific companies

1SASB. 2021. Materiality Finder Overview – SASB. [online] Available at: <https://www.sasb.org/standards/materiality-finder/>.