5 minute read

One of the biggest challenges to understand, and therefore embrace, responsible investment in all its forms is in the confusion and lack of consensus around terminology.

To ensure that we are all speaking the same language, this section lays out the definitions and context that run through this module and the rest of this course. All definitions are those identified and used by the CFA Society of the UK.

Types of ESG investing

Responsible investment is a strategy and practice to incorporate environmental, social and governance factors into investment decisions and active ownership.

ESG investing is “an approach to managing assets where investors explicitly acknowledge the relevance of environmental, social and governance (ESG) factors in their investment decisions”.

- Environmental factors are those pertaining to the natural world

- Social factors are those that affect the lives of humans

- Governance factors are those that involve issues inherent to a business’s model or common practice in an industry

Socially responsible investment (SRI) refers to approaches that apply social and environmental criteria in evaluating companies.

Best-in-class investing involves selecting only the companies that overcome a defined ranking hurdle, established using ESG criteria within each sector or industry.

Sustainable investment refers to the selection of assets that contribute in some way to a sustainable economy (e.g. investing in technology that extracts reusable components from recycled material).

Thematic investment is the selection of companies that fall under a sustainability-related theme (e.g. clean-tech, sustainable agriculture).

Green investment refers to allocating capital to assets that mitigate climate change, biodiversity loss, resource inefficiency and other environmental challenges (e.g. focusing on investments that are committed to the conservation of natural resources or pollution reduction).

Social investment is the allocation of capital to assets that address social challenges (e.g. improving access to education, childcare or healthcare, among others).

Impact investing refers to investments made with the specific intent of generating a positive, measurable social and environmental impact alongside a financial return (e.g. developing renewable energy sources or sustainable agriculture).

Ethical / value-driven / faith-based investment is investing in line with certain principles. It usually involves a negative screen to remove companies whose products and services are deemed objectionable by the investor (e.g investing in line with Shariah laws).

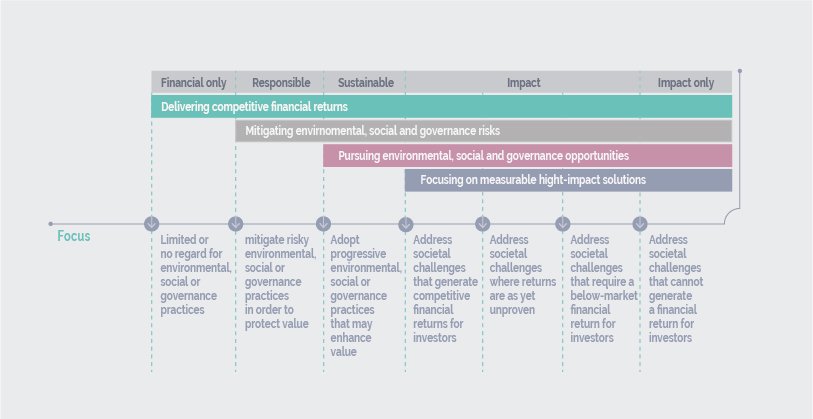

The graphic below adapted from the Organisation for Economic Co-operation and Development (OECD) summarises the focus of investors within the different classifications of responsible investing.

Read: Pages 6-7 of PwC report – 2022: The growth opportunity of the century

Read: Pages 6-7 of PwC report – 2022: The growth opportunity of the century

Key points:

- ESG is a fundamental paradigm shift in the investment landscape placing financial and non-financial performance on a level playing field

- PwC anticipates that in a best-case scenario, ESG fund assets under management will account for over 50% of total European mutual fund assets by 2025

- PwC identifies four key catalysts that drive the sustained growth of ESG:

- Complete regulatory overhaul – shifting from voluntary initiatives to binding legislation. As the regulatory landscape develops, unsustainable corporations will lose out on capital and non-compliant sectors will be penalised as a result.

- ESG’s outperformance – the previously held misconception that investors must sacrifice strong returns in order to be sustainable has been widely disproved. ESG-aligned assets outperformed in the wake of the COVID-19 sell-off, and this trend is anticipated to continue.

- Increasing investor demand – a shift in societal values has given rise to a new generation of investors who prioritise non-financial impacts alongside financial return. Managers face increasing client pressure to incorporate ESG standards into their offerings.

- Fundamental societal shifts, magnified by current environmental, social and health crises. Public awareness of ESG-related risks has catapulted climate change and sustainability to the top of the global agenda, accelerated by COVID-19.

Module 2 will take a deeper dive into the products and strategies at play in the Responsible Investment universe.