The European industry

Top 10 asset managers:

Challenges and trends

- There has been solid growth over the years. When COVID-19 hit, stock markets suffered and growth was hampered, but by the end of the second quarter of 2020 growth had picked up again.

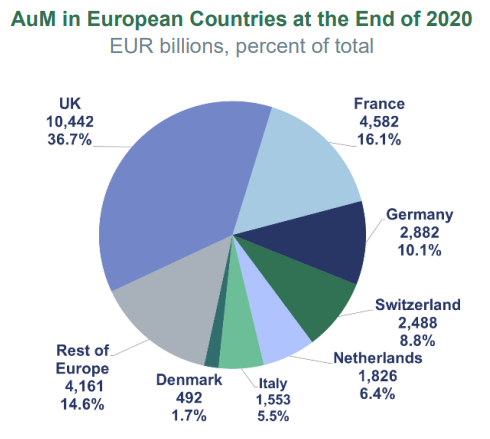

- Assets are concentrated. Five countries cumulatively own 76% of the financial assets in Europe, with the UK alone owning 36.7%.

- The product market in Europe is saturated. Aware that the investing population is likely to be financially savvy, with access to significant savings, product providers have produced a dizzying array of different funds and investment vehicles. This makes it difficult to products to stand out.

Snapshots of European financial services industries

The UK

- Overview

- The largest asset management hub in Europe and the second-largest in the world, after the US.

- 79% of assets are managed by institutional investors. Pension schemes are the largest institutional investors.

- Assets are relatively unconcentrated, spread across a large number of firms.

- The UK is a key centre for portfolio management on behalf of global investors, with £3.7 trillion in funds.

- Distribution

- The distribution of retail funds in the UK remains heavily intermediated.

- Trends

- Global asset allocations to create greater diversification.

- Passive investment remaining strong.

- Interest in private markets from pension schemes and insurance companies.

- Sustainable investment, which is mainly institutional-driven. However, retail investors are catching up.

- Challenges

- Adapting and maintaining a competitive advantage post-Brexit.

- Embracing technological change.

- Sustainability.

Italy

- Overview

- The fifth-largest asset management industry in Europe by AUM, after the UK, France, Germany and Switzerland.

- A saving culture, which is a compelling prospect for fund managers because it means citizens are likely to have capital to invest.

- Italian investors generally favour lower levels of risk, often lack financial education and prefer safer financial instruments.

- The market for mutual funds has grown in Italy.

- Distribution

- Dominated by banks.

- However, there has been a loss of faith in local banks. More diversified offerings, technical competence and trust-based relationships with distributors have led to asset managers growing in prominence.

- Trends

- Multi-asset products have overtaken traditional funds.

- The introduction of tax-free PIRs (ISAs) is attracting new money to the industry.

- Challenges

- MiFID II is changing the dynamics of financial advice, creating a more personalised, ad-hoc advisory sector.

- Forming strategic partnerships.

Switzerland

- Overview

- The most competitive financial centre in the world.

- Flexible and pragmatic regulations paired with political stability mean that Switzerland occupies a unique position in the global financial services industry.

- Switzerland is a global leader in cross-border wealth management, commanding 25% of the worldwide market share in this field.

- Distribution

- Two major financial centres (Zurich and Geneva).

- A highly competitive market, split between local fund providers and several foreign competitors.

- Bank-owned asset managers.

- Synergies between different areas of the banking sector.

- Trends

- Switzerland is renowned for sophisticated investment products and strategies, and is a leader in alternative investments.

- The nation is a pioneer in sustainable finance. 30% of Switzerland’s AUM is invested sustainably, vs. the global average of 15%.

- High digitalisation is a priority.

- Challenges

- Customer acquisition.

- Asian rivals.

Germany

- Overview

- A strong pillar of the European asset management industry, with €3 trillion in AUM. AUM doubled between 2008 and 2017.

- The four largest local players dominate the market, commanding 70% of market share.

- Foreign and independent firms face tough competition from banking and insurance companies.

- Distribution

- More than two-thirds of German insurance assets are life insurance assets.

- Investors are generally conservative, but have a growing interest in alternative investments.

- Financial advisers and asset managers have a profitable relationship.

- Trends

- ETFs, both in the institutional and retail sectors.

- Thematic equity funds.

- Multi-asset funds (especially among advisers).

- Sustainable, real asset and private markets investing.

- Increasing institutional investments into funds.

- Challenges

- Corporate governance.

The US industry

At a glance

- The US is the largest asset management hub in the world.

- The COVID-19 pandemic severely disrupted the US asset management market and the real economy worldwide. These extraordinary events prompted large-scale economic intervention from the US government and central bank (The Federal Reserve, or ‘Fed’).

Challenges

- A decrease in profitability and fee pressure.

- Fierce competition, both within the industry and from outside competitors.

- Increasing pressure from regulators.

- A rapidly changing technological landscape.

Trends

- Alternatives are becoming more mainstream.

- Passive investments continue to race ahead of active ones.

- Political divisions over ESG investing are deepening.

- There is a rising demand for customised solutions.

- There is a greater focus on diversity and inclusion than the EU.

- Markets are favouring stocks over bonds.

ESG in the United States

Anti-ESG sentiment has begun to make waves across the financial services industry in the US. An increase in anti-ESG litigation across states that include Texas, Florida and Indiana reflects the increasingly polarised and political nature of discourse around this field. Conversely, pro-ESG legislatures are facing increased pressure to protect ESG standards and policies.

Many asset management firms on both sides of this debate are claiming that their ESG investment strategies are largely client-driven, rather than deriving from any form of moral grandstanding. Adapting to the needs and preferences of clients, as well as the current political climate, requires fund managers to minimize any potential ambiguities in their strategies.