An anti-ESG sentiment began to make waves across the financial services industry in the US this summer. This has only been compounded in the second half of the year so far, as we’ve seen an increase in anti-ESG litigation across states including Texas, Florida and Indiana. The most recent addition to the clamor was from Treasurer for the state of Louisiana, John Schroder, who announced in a recent letter to BlackRock that the state will divest nearly $800 million from the company because of its ‘enthusiasm’ for sustainable investments. Conversely, pro-ESG legislatures are facing increased pressure to ensure state and local treasurers do everything possible to address concerns around ESG.

Thus far, over 15 state treasurers have publicly signed up to For the Long Term, a non-profit organization whose mission is to ‘help public treasurers leverage the power of their offices to deliver sustainable long-term growth’.

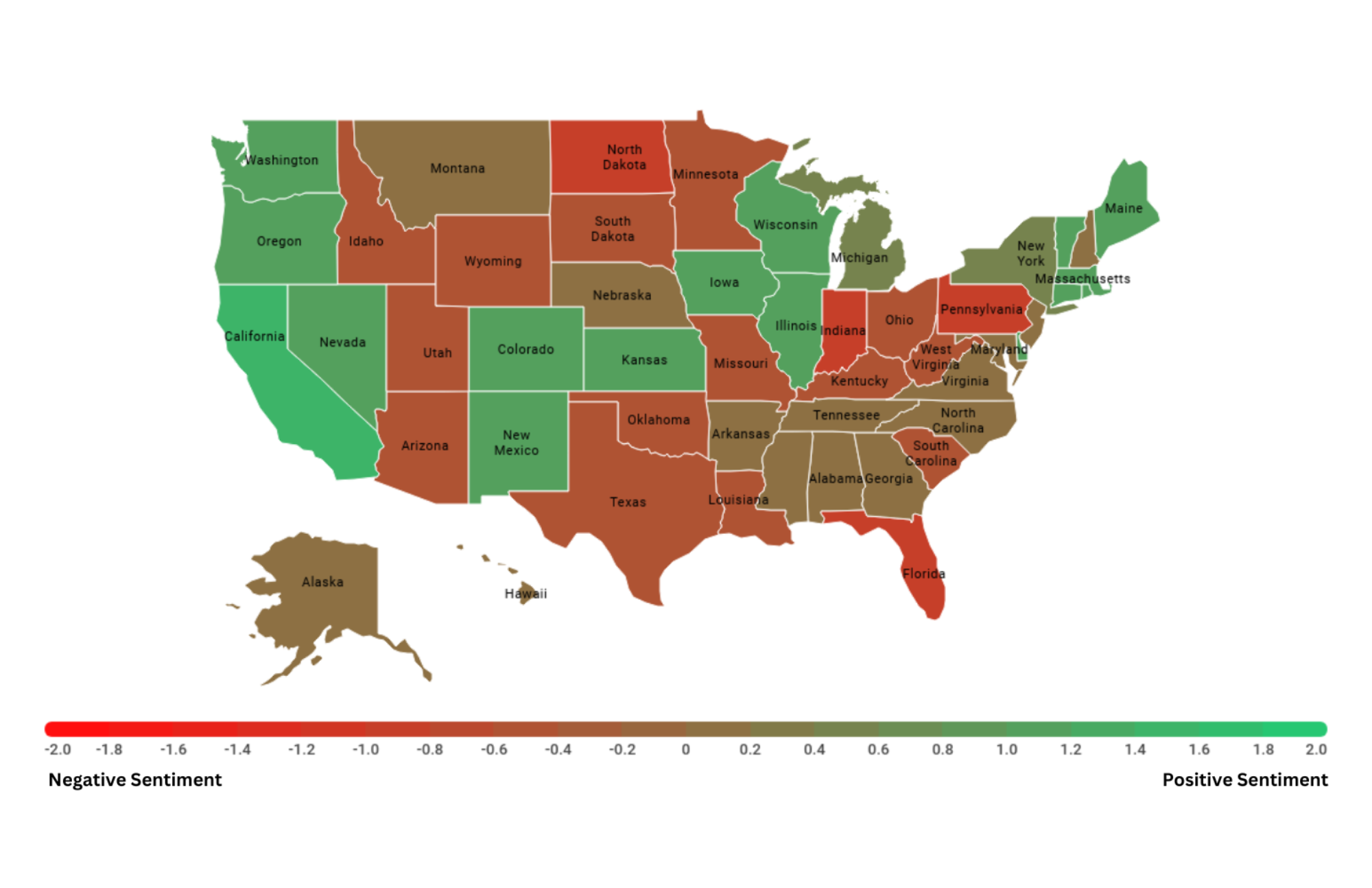

With the intention of building a better understanding of the impacts of the anti-ESG movement on a state-by-state basis, we have created a map that illustrates the leanings of individual states in this area, on the basis of the most recent legislation or statements they’ve issued. Sentiment towards ESG is plotted state-by-state based on current and proposed ESG regulations as of 10.10.22, and signatures of the For the Long Term non-profit list.

Key Marketing Considerations

Responsible Investor articulate a view held by many, regardless of their stances on anti-ESG legislation, that ‘removing this tool (ESG) from the investment toolbox is as misguided as removing any other risk analysis tool’. However, this volatile and rapidly changing landscape has left the strategies of many fund managers in disarray. A hedge fund advisor at NorthPeak shared that “anecdotally, we have heard cases of managers feeling the need to create two separate pitchbooks to avoid politicized debates about values, even though their investment process is the same.” The question thus becomes – given the turbulent climate, how do we communicate the ESG dimensions of investment products to clients without alienating certain investors?

We have outlined some key considerations to help investment marketers navigate the topic:

Understand concerns from both sides

It is clear that ESG conversations are becoming increasingly nuanced and complex in the US. It is important to remember that, as marketers, our first responsibility is to understand the marketplace in which our products exist. This encompasses building an understanding of a range of perspectives, so that we’re able to effectively communicate with our target audience and address their concerns. The map above helps us identify potential hotspots where ESG messaging may require additional context, nuance, or re-framing. It allows us to track consumer appetites and behaviors across geographic regions, which is an important step in the marketing process for any product, not just those related to ESG.

As Marina Severinovsky, Schroders’ Head of Sustainability for North America, observed: “It’s about having empathy, recognizing that (ESG objectors) care a great deal [about climate change], but that they also have to consider the local economy.” The topic of ESG, therefore, must not only take into account values – of cities, states and nations, as well as individual investors – but also the practical concerns that underpin their investment decisions. As the US mid-term elections approach, it is essential that strategic decisions regarding marketing exhibit the appropriate sensitivity

Get to know your client’s unique ESG appetite

Many firms on both sides of this debate argue that their ESG investment strategies are largely client driven, rather than deriving from any form of moral grandstanding. Adapting to the needs and preferences of clients, as well as the current political climate, requires fund managers to minimize any potential ambiguities in their strategies. A growing number of firms are making use of tools such as quizzes and questionnaires when advising clients on ESG investments. This approach enables individual advisors and firms to create personalized investment solutions for their clients based on individual ESG preference

The conversation and controversy surrounding ESG investing are not going to abate any time soon. Key upcoming events in this field, such as the US midterm elections and COP 27 summit, are likely to further enflame discourse. Now, more than ever, it is paramount to balance our investors’ stances regarding sustainable investing against the authentic position of our own firm and adjust our messaging accordingly.