At the beginning of this year, we worked with MainStreet Partners to produce the first ESG Barometer: an unbiased analysis of the ESG fund and ETF landscape. Easy-to-understand and consistent sustainability ratings are notoriously hard to find. The ESG Barometer aims to bring clarity to this situation. Updated annually, the report will aid investors in navigating the rapidly growing and increasingly important ESG, sustainable and thematic fund/ETF universe.

A year on from the introduction of the EU Sustainable Finance Disclosure Regulation (SFDR), the report offers a fund-level analysis of approximately 4,200 funds and ETFs assessed and rated in the MainStreet Partners universe. The team at MainStreet Partners has developed a proprietary methodology that goes beyond many of its peers’ ratings, which tend to be based exclusively on the underlying holdings of a portfolio.

A comprehensive analysis

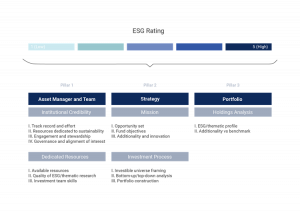

Their approach to both qualitative and quantitative analysis encompasses three pillars of assessment:

- The overall asset management firm

- The fund’s investment and ESG strategy

- The components of the underlying portfolio

The ESG scores range from 1 (low) to 5 (high), but the final rating is not simply an average of the three pillars outlined above. In total, they assess 80 indicators, each of which has a specific weighting in the overall score. Additionally, the model includes “bonus” elements, which are dependent on the category a particular fund or investment sits in.

Key findings from the report:

SFDR aims to bring clarity and consistency to how funds are labelled from a sustainability perspective. While this regulation is certainly a start, there is still significant variation among products in each category. This in-depth analysis of funds across regions, asset classes and size of asset managers shows some interesting observations:

- Europe continues to lead the way on sustainability disclosure, regulation and ESG integration. In contrast, the US is still at the start of its journey. On average, Article 9 funds managed by asset managers head-quartered in Europe, score a notable 0.4 points higher than their US counterparts.

- Boutiques performed better than their larger competitors at both the strategy (Pillar 2) and portfolio level (Pillar 3). Large and medium-sized managers scored highly at asset manager level (Pillar 1).

- Multi-asset funds tend to have both a lower degree of ESG integration in their investment objectives and are less aligned to the Sustainable Development Goals compared to other categories or sectors. On average, multi-asset funds score 0.6 points (c. 12%) less than other asset classes for Article 9 funds.

Most funds in the MainStreet Partners universe remain focused on environmental themes, while social themes account for only 7% of the thematic category. Flows also reflect the dominance of environmental themes, perhaps given the current preoccupation with net-zero targets. Article 9 environmental funds have an average of EUR 1.3 billion in assets under management. Social funds in the same classification average EUR 384 million.

Overall, the classification of funds under Article 8 and 9 has correlated with larger inflows into these products, suggesting that investors are placing their trust in these labels. However, assessing the degree of genuine ESG integration has arguably become more difficult. This is due to the diversity of products on show and the absence of standardisation. Around a fifth (21%) of funds which have been classified as Article 8 have achieved a MainStreet Partners ESG Fund Rating of less than 3 out of 5. Missing this threshold of 3 means that these funds would not be classified as “Sustainable ” by MainStreet Partners.

Find the full report here, including regional and asset-class level analysis and more details on emerging themes such as hydrogen and sustainable food.