5 minute read

The sustainability messaging and positioning of the key players in the asset management industry is far from a fixed or static position. We are going through a period of significant change in attitudes and priorities and as such are seeing many players, large and small, coming out with updated messaging with a responsible investing/ sustainability orientation.

Research carried out by White Marble in the UK in Summer 2021 sought to rank a selection of asset managers based on their perceived brand authenticity in relation to sustainability, and the perceived quality of the ESG content and marketing. Respondents were drawn from across the retail and institutional space.1

Brand authenticity for sustainability

| Ranking for brand authenticity for sustainability | Ranking for quality of ESG content & marketing |

|---|---|

| BMO | Schroders |

| Schroders | BMO |

| Amundi | Amundi |

| BNP Paribas | Columbia Threadneedle |

| Wellington | abrdn |

| Columbia Threadneedle | BNP Paribas |

| Allianz | Fiddelity |

| Natixis | BNY Mellon |

| abrdn | Natixis |

| BNY Mellon | JP Morgan AM |

| Janus Henderson | Allianz |

| M&G | Janus Henderson |

| Capital Group | M&G |

| PGIM | Pimco |

| T. Rowe Price | Franklin Templeton |

| Pimco | PGIM |

| AXA Investment Management | AXA Investment Management |

| Fidelity | Wellington |

| Franklin Templeton | Invesco |

| MFS | MFS |

| Northern Trust | T. Rowe Price |

| Invesco | Northern Trust |

| JP Morgan AM | Capital Group |

| Barings | Barings |

| GSAM | GSAM |

Three firms dominate the top of the rankings at a corporate level – BMO, Schroders and Amundi. A closer examination of what these firms are doing to help them stand out in this space can help us understand how others may also succeed.

It is worth noting that the three leaders at a corporate level did not necessarily have the level of recognition when respondents were asked to identify leaders at the different thematic levels. Similarly, the likes of Columbia Threadneedle, WHEB and Federated Hermes, who were mentioned repeatedly as leaders in sustainability, fiduciary duty and stewardship, rigorous ESG integration and demonstrable change through long term engagement, generally did not score as highly at the brand recognition level, with the exception of Columbia Threadneedle who made it into the top quartile for brand authenticity as well as content and marketing.

Above all, this demonstrates that there is still plenty of room for improvement, as firms grapple to align their corporate/ brand messaging with their capabilities and product level messaging.

Authenticity case study – BMO

Taking a closer look at a brand that has ranked highly for their perceived authenticity and strength of content and marketing can help us to understand what is landing well with their audience.

![]() Listen: – AIM High: Building sustainability credentials in your brand – Twink Field, CEO of White Marble Consulting, Benjie Elston, Director and Head of Sustainability at White Marble Consulting and Ross Duncton, Head of Marketing & Direct at BMO Global Asset Management (EMEA).

Listen: – AIM High: Building sustainability credentials in your brand – Twink Field, CEO of White Marble Consulting, Benjie Elston, Director and Head of Sustainability at White Marble Consulting and Ross Duncton, Head of Marketing & Direct at BMO Global Asset Management (EMEA).

Key points:

- Investor responses generally were more positive on investment performance of sustainability labelled/ mandated funds, and were less positive on the approach / sustainability strategy employed, and were significantly less positive on the marketing and communications perspective.

- The fact that some players ranked differently to how might have been expected based on the rigor of their processes, highlights how important authentic and consistent message articulation and communication is.

- The challenges of the level of contextual understanding required to write authentically about sustainability and ESG mean that there is a risk of content being out that is built on unsteady foundations – which leads to a lack of authenticity and credibility.

- The research highlighted that performance is not everything – investors want to see how firms are measuring social and environmental impact, and walking the talk.

- Authentic brands are built from the inside out – so understanding what your underlying proposition is, is key. Marketing plays a very important role in this.

- The fact find/ discovery stage of BMO’s journey to articulate their sustainability positioning was key to ensuring an authentic output, and to bringing key stakeholders within the business along on the journey.

- Active support and advocacy of CEO, CIO and Head of Distribution was key to the BMO projects success.

- CIO and Head of Distribution bring, respectively, insight on what capabilities exist, and what resonates with the market – the role and skill of marketing is how to package those two components together.

- Transparency and honesty on key milestones and targets was key to managing those important stakeholders.

- Visible support from those key heads of departments cascades down through their departments to get the buy in needed in key areas of the business.

- There are greater differences between the multiple audience segments that asset managers market to than is often credited – and these different segments look for / are concerned by different factors, but consistency is still key.

- Having a strong overarching message enables consistency – whilst certain elements can be dialed up or down depending on the audience type.

- Authenticity is key to success – there is space in the market, but only if brands are trusted and authentic in their positioning.

- BMO examples – individuals in the business truly believe in and have an understanding/ knowledge of the proof points that support their positioning.

- This means corporations have to decide what kind of business they want to be: A business that just does no harm? A business that provides sustainable solutions? A sustainable business? As well as what it is that you are good at/ what space you want to own. No one can be champion of everything – it’s not credible.

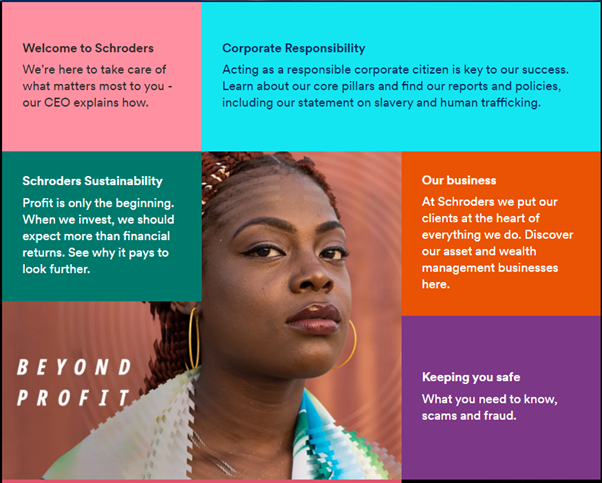

Content and marketing at corporate level case study – Schroders

Schroders are a good example of the pattern mentioned earlier, where firms that did not gain significant recognition for their specific sustainability activities nonetheless ranked very highly for general brand recognition for sustainability. Schroders was also the highest ranking first from a content and marketing perspective, a category in which almost all the firms ranked scored lowest (Schroders scored 3.4 to come in second in the brand level ranking, but topped the content and marketing ranking with a score of 3.3).

So, what are Schroders doing from a marketing perspective that is driving these high levels of recognition?

One of the biggest factors is likely to be the recent Beyond Profit campaign. Schroders are not afraid to step away from the restrained and more traditional aesthetic and approach that is dominant in the asset management industry. Everything from distinctly consumer goods flavoured campaign video to the use of bold blocks of colour makes this campaign, and therefore the message that it is pushing about the brand, stand out.

Schroders, and their employees, are also very active on platforms such as LinkedIn, sharing sustainability stories and their research and work. They use simple and accessible language to have a wide appeal and appear relatable. They use one channel to target different audiences, in different languages. This ever present approach contributes to good brand recognition for sustainability topics.

1 Throughout May 2021, we interviewed 100 independent financial advisers, wealth managers, discretionary fund managers, pension trustees, independent trustees, consultants and a small number of financial journalists and commentators. These professionals work closely with asset managers every day and have a first-hand view of how the industry is evolving amid a blizzard of product launches.